One of the good things that has happened to me since I opened a Twitter account is that I receive many interesting ideas from followers from different countries, whereas my own ability to come up with those ideas is quite limited. This idea came from one of my followers from Bulgaria.

One of the good things that has happened to me since I opened a Twitter account is that I receive many interesting ideas from followers from different countries, whereas my own ability to come up with those ideas is quite limited. This idea came from one of my followers from Bulgaria.

Allterco (A4L) Frankfurt

Number of shares: 18,000,000

Stock price: 9.7 euros (in Germany)

Market capitalization: 175 million euros

Before I will talk about the company, a few words about the stock dynamics. It is a Bulgarian company, dual-listed on the Bulgarian Stock Exchange and also on the Frankfurt Stock Exchange. The company was listed on the Frankfurt Stock Exchange at a price of 14 euros, and quickly the stock price rose to 16 euros. However, since then, it has declined along with the overall growth stocks, and particularly after the war in Ukraine, despite the fact that the company has no exposure to Ukraine. It is a profitable company that can be valued based on a simple earnings multiple. I have been following the company for over half a year and feel comfortable writing about it after seeing several quarterly results. I also met the company’s management in Germany a few months ago and had more than five Zoom calls with the company.

Brief history

The company was founded in 2003 for the purpose of designing and manufacturing hardware systems for various cellular operators. There is not much connection between the company’s current products and how the company started, but it is important to understand the background for the continuation. In 2013, the company established its IoT division and began building the foundations of what the company looks like today. In 2015, Allterco started selling GPS tracking watches for children, known as MIKI, which still exists in the company today. The interesting product that has been the focus of most of my work is called SHELLY, and the company began selling initial products somewhere in 2018. In 2019, the company sold its telecommunications business and now focuses most of its efforts on developing home IoT products.

Shelly Products

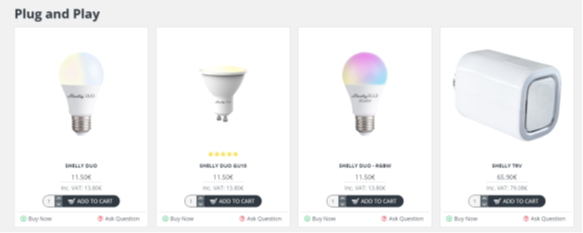

The company manufactures IoT products for smart homes that are inserted into electrical outlets and enable control over all electrical devices in the house. The company’s products operate on Wi-Fi and come with a dedicated app that allows controlling all the devices in the house. The physical connection is relatively simple – you disassemble the socket, insert the Shelly product, and then you have the option to control and monitor every electrical point in the house.

In addition, the company’s store also offers specialized products such as variable lighting bulbs, window opening and closing sensors, smoke and gas detectors, and energy-saving products.

From the descriptions I wrote, it can be understood that the company specializes in smart home products, one of the fastest-growing niches in the world.

Market Description

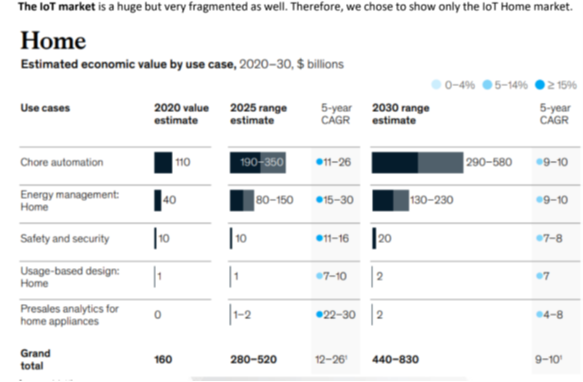

It is very difficult to define the exact TAM for Allterco, but what is clear is that the company is at the beginning of the trajectory, and the trajectory itself will be long.

As can be seen in McKinsey’s graph, they talk about a growth of 12-26% depending on different segments.

In a presentation Allterco published in 2020, the company set a goal to be in 1.4% of smart homes in the Western world.

One of the things I love the most about the companies I choose is being in a growing market. Just like in the past with the investment in Telsis, which was in one of the growing markets in the electronics field. A growing market can compensate for many less-than-optimal management decisions, so it is definitely an important aspect in my investment choices.

The Company’s Business Model

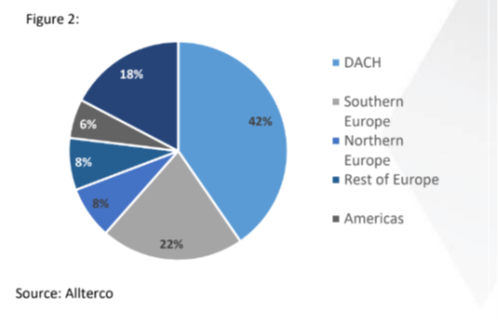

Despite being a Bulgarian company, Allterco’s almost sole connection to Bulgaria is its development center since most of the company’s sales are made in Western Europe and the United States. The company benefits from cheap labor in Bulgaria, less competition from strong companies, and most of its sales are in euros.

In the chart below, you can see the breakdown of the company’s sales per country.

Allterco conducts all its R&D activities in Bulgaria, while the company has three manufacturing sites in China. Allterco purchases its components from various suppliers and maintains the design flexibility of its products, which allows the company to easily overcome component-related challenges. In addition to hardware, the company also develops specialized software and works on upgrading its application, but I will expand on that later.

The company’s sales model is divided into two categories: direct sales to end consumers through online stores and an Amazon store, and working with distributors. Around 30% of the products are sold through online stores and the rest through distributors. The company has a representative office in Germany, which is currently its main market, and in the future, the company plans to open representative offices in other countries.

Competition

There are several competitors in each category of the company’s products. When thinking about competition, it is important to remember that the product installed in a home can control a lot of data in the future. Therefore, there are several aspects that are very important to consider, such as user data security and where this data is stored. Therefore, I don’t see much chance for Chinese companies to penetrate this market. From my research in various developer forums, I think Shelly enjoys several advantages:

- Software automation

- Product size

- Convenient price

To determine whether a product is a commodity or a company with a specific advantage, it is important to look at the companies’ gross margins and see if there is a downward trend over time. From my investigation, Shelly manages to maintain high gross margins alongside continued growth. Shelly products are in the early stages of growth, there are several years before competition begins to impact the profits.

Here are some of the comments I found about the company on Amazon:

“This is a great device at an incredible price. Before trying these, I automated switches by replacing the entire switch. This left a lot to be desired because dedicated smart switches weren’t great. They felt and sounded like clicking a computer mouse since they used micro switches internally. By using a device like these Shellies, you’re able to use any switch you like, so I can keep the classic electrical switches I’ve grown accustomed to.”

“The stock firmware on these guys is incredibly capable compared to competitors. I was astonished. It’s not unpolished Chinese software that you may expect, it’s very well done and very capable. With the recent update, I don’t have any reason to try custom firmware like I originally expected to.”

“Before we start talking about the device, we have to talk about the cool and fast app. Shelly is one of the most important devices in my home, very practical and compatible with many automation systems. I did a review for this device on my YouTube channel, WeSmart.”

If you think these comments are random and that all products enjoy such popularity, that’s not the case. The founders of Shelly are passionate about product quality. They are technology IoT enthusiasts, and the product gains significant popularity in the developer and smart home installation communities.

To reinforce my research on the company, I met with the distributor and installer of the products in Israel. We discussed the product’s advantages, especially usability, ease of installation, and good support from the company for inquiries. In addition, the company’s products are becoming a standard in the industry, and there are dedicated chat forums where they solve issues, which increases the desirability of using the product for new installers since it save a lot of time.

Financial Numbers

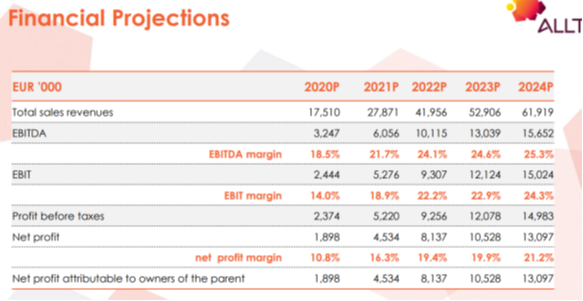

Before presenting the company’s financial results and my forecasts for the coming years, it’s important to present the company’s stock forecasts that they made in 2020. It’s worth noting that during the years of the forecasts, there were the COVID-19 pandemic, the crisis in Ukraine, and concerns about inflation in Europe.

Actual results for the years 2020, 2021, and forecasts for 2022, 2023, and 2024 are shown in the table below:

It can be seen that the company has performed much better than the forecasts they gave in 2020.

Additionally, a few weeks ago, the company released forecasts for the upcoming years that, for some reason, didn’t receive much attention from the market.

Link to the company’s forecasts

A few days ago, the company published its results for the first half of 2022, which exceeded management’s expectations. In the latest publication, the forecasts for 2022 were approved.

Comparison to Competitors

The company has published in its investor presentation a number of companies with which it compares itself, such as Alarm, Vivint, and SOMFY. All the mentioned companies trades at very high profit multiples, grow slowly, and on the other hand, offer a different range of services, including subscriptions for customers.

The most relevant competitor, in my opinion, is PLEJD, a Swedish company that is growing at high rates (slightly above Allterco), specializes in the Scandinavian market, and trades at a profit multiple of over 50

Optionality

One of the points I think the market overlooks about the company is the significant optionality it offers

Allterco has sold over 6 million devices so far and is likely to sell over 6 million more in the coming years, meaning over 10 million connected devices in people’s homes. Currently, Allterco is working on upgrading its user application and plans to start offering some paid services on a subscription model starting next year. Some of these services may include troubleshooting electric devices that consume above-average energy and contribute to the electricity bill, real-time reporting of window opening or closing reprted directly to the call center, and other services. Even if, let’s say, only 10% of people want to subscribe and agree to pay a few euros per month, it represents a significant contribution to the company’s profits, as these revenues will directly impact the bottom line. Additionally, the company is working on algorithms for network fault monitoring that can cause damage to electrical devices, and it can sell that data to manufacturers. It is important to note that this optionality was not included at all in the forward projections, and I believe there is a reasonable chance of a positive surprise in the financial results.

Shareholders and Management

The two founders of the company together hold about 65% of the company, and Dimitar Dimitrov also serves as the joint CEO of the company and is primarily responsible for product development. To support business development and transition to the growth stage, Wolfgang Kirsch was appointed as joint CEO of the company. I met Wolfgang in Germany a few months ago, and he left a very positive impression on me. He is a manager who was responsible for sales at MediaMarktSaturn in Germany and significantly grew the business. He has a very well-structured work plan for the company, and as a graduate of McKinsey, he also brings disciplined methodologies and goals to the company. I particularly like the stage where the founders say that someone talented from the outside needs to take the company to the next level.

Risks

It’s important to remember that we are dealing with a small Bulgarian company with small trading volumes, so the stock may not interest anyone for a few months. Despite the possible lack of short-term interest, I am confident that as the company continues to perform well, interest in it will grow, as will liquidity. Additionally, one of the founders may want to sell some of their stocks at higher prices.

Despite optimistic forecasts and the fact that the company has met their past projections, it’s always important to remember that these are just forecasts and that the industry is highly competitive. It’s important to continue monitoring whether the company is able to execute according to their plans.

There is a risk of planning failure, as the product is connected to high voltage and any technical failure could result in costly recalls and potential lawsuits.

Summary

Altreco is positioned in a rapidly growing niche and benefits from the popularity of its product among developers and installers. I estimate that the growth will continue for several years. Furthermore, in the future, Altreko can benefit from subscription revenues that are expected to further improve its income profile. At current prices, investors are paying a multiple of 19 for the 2022 earnings and a multiple of 12 for the 2023 earnings of a company expected to grow by nearly 40% for several years, with high margins and quality management. It is difficult for me to see the price remaining the same for an extended period as long as the company continues to execute according to its plan.