I want to present a company that I see as one of the interesting opportunities in today’s markets. It combines growth, quality, and stable business, new management, a large holder entering the board, and a positive business environment cycle. Meet Sylogist (SYZ.TO), traded in Canada with a market capitalization of 180 million Canadian dollars and an average daily trading volume of 250,000 dollars.

I want to present a company that I see as one of the interesting opportunities in today’s markets. It combines growth, quality, and stable business, new management, a large holder entering the board, and a positive business environment cycle. Meet Sylogist (SYZ.TO), traded in Canada with a market capitalization of 180 million Canadian dollars and an average daily trading volume of 250,000 dollars.

The Business

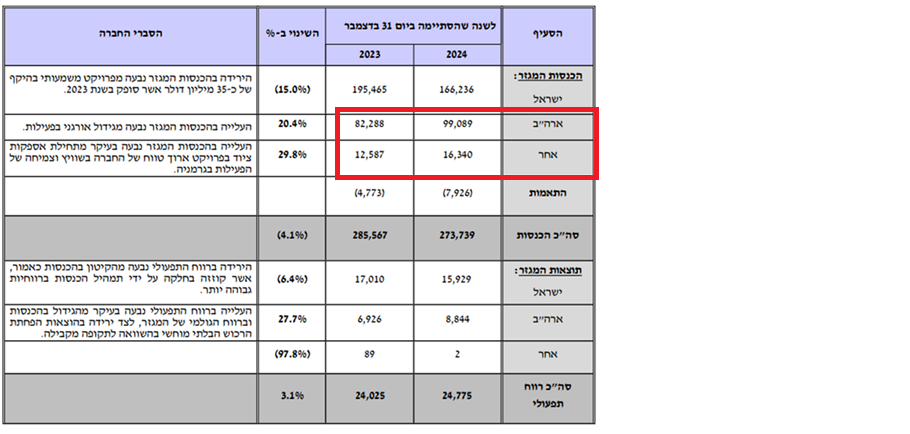

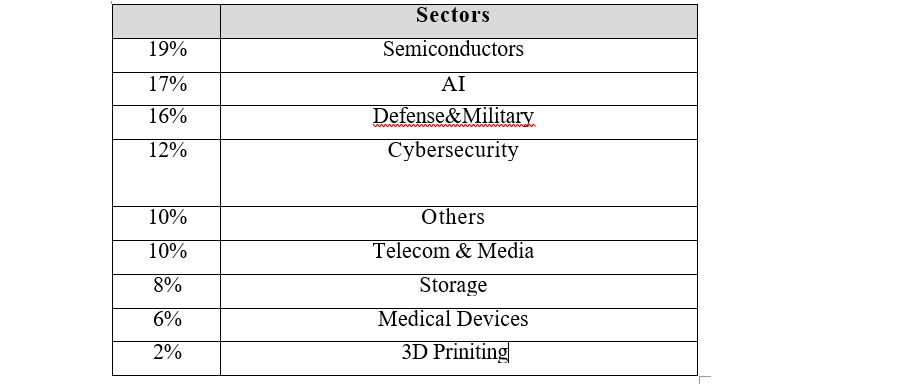

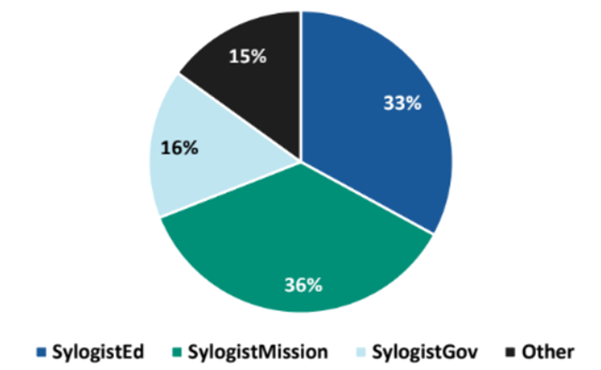

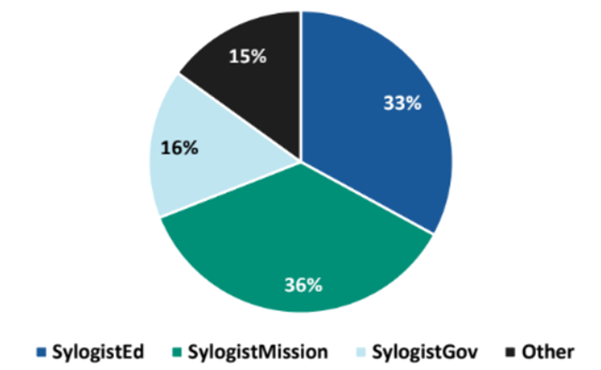

The company develops ERP and CRM products for three main verticals. For the non-profit sector through the SylogistMission division, for the education and schools sector through SylogistEd, and for municipal services through SylogistGov. In each field, the company has many clients, mainly in the USA and Canada.

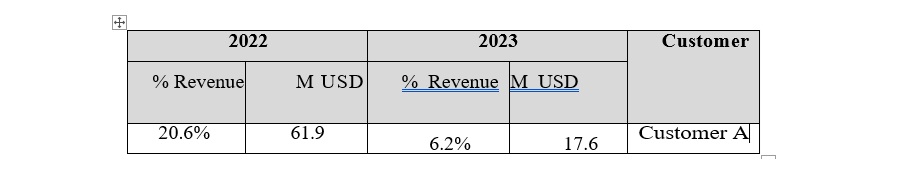

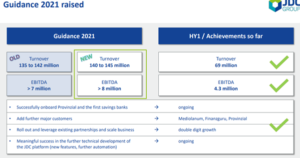

Looking at the revenue breakdown, approximately 36% of the revenue comes from the Non-profit sector, around 32% from ED, and around 16% come from GOV.

Another 15% comes from verticals in other areas.

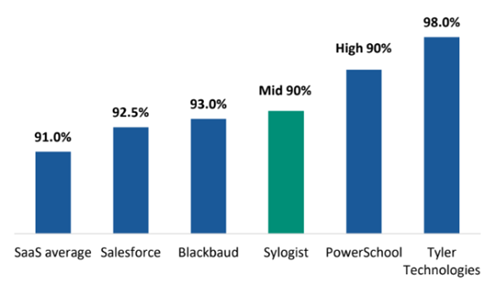

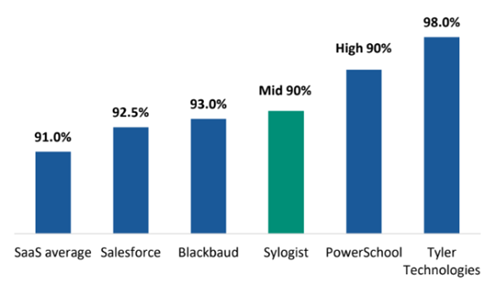

The ERP & CRM segment for organizations is very sticky business, as changing a provider brings significant headaches. Of course, it’s not just a gut feeling; it’s also reflected in the numbers. The churn rate is the lowest within SAAS companies and mostly comes as the last choice by the end customer. Customer retention rates for companies in this sector are even higher than those of Salesforce.

Source – Canaccord Research

Sylogist product and customer support are of good quality and continuously improved during last years . For example, here’s an excerpt from one of the support calls I read at Tegus:

“Yes. So the software is good. I mean, it really is a Microsoft product. And Microsoft like when they initially came out with Excel, not to date myself, it was horrible. But over time, they made a really good product, and pretty much that’s the industry standard. And I feel like Microsoft has generally improved quite a bit over the last 10 years on what they provide, that makes Serenic that much better. But I have to say their customer support is way better than any other software products that I’ve dealt with”

Brief Review of Sylogist products

Sylogist ED is an education software for managing accounts, student registration, billing, and more. Sylogist entered the education software field in 2017 with the acquisition of K12 Enterprises, and in 2021, they acquired MAS, which accounts for 85% market share in the school and education institutions sector in Oklahoma. In the conversation we had with Bill, the CEO of Sylogist, he explained that a number of private equity firms wanted to buy MAS at much higher prices, but the CEO of MAS didn’t want to sell. Only his personal acquaintance with Bill and a promise to preserve the product led to the deal.

Sylogist has significantly improved the product and offer during the last two years, and they are now expanding into more regions. The product went live in North Dakota in July. A government incentive program will lead to increased budgets in the software upgrade sector and serve as a catalyst for growth. In our conversation with the CEO of Sylogist, he mentioned that many schools still use outdated local software and are looking to upgrade to the cloud. In the recent conference call, the company also highlighted that they see a very strong business environment.

“On the SylogistEd side, following the successful lift and shift of our software platform from Oklahoma to North Carolina in a top-10 school district in North Carolina, having gone online on live on SylogistEd right on schedule. We are seeing several other districts leaning into follow suit. I see us as very well positioned to accelerate in North Carolina over the next 12 months and elsewhere in the back half of ’24.

As I’ve said before, we’re just getting started in the SylogistGov and SylogistDev markets and the value creation opportunity we see ahead is large, very large.”

According to Gartner, IT budgets for educational institutions are expected to increase by 9% annually until 2026, which is expected to support Sylogist’s organic growth. The company’s major competitors in the field are PowerSchool and Tyler, which focus on larger districts compared to Sylogist.”

SylogistMission provides SaaS-based ERP, CRM, and analytics solutions

for non-profits organisations. Company products built on Microsoft dynamics 365 and include verticals like fundraising, payroll and grant management.

There are over 1.5 million non-profit organizations in the United States, with around 120,000 of them having a budget of over 1 million dollars per year, making them potential customers for Sylogist.

The intriguing aspect of this segment is that the direct and major competitor, Blackbaud, has an outdated product that was developed many years ago and hasn’t been upgraded since. Blackbaud is undergoing a massive process of contract renewal with quite aggressive price increases, creating a good potential for Sylogist to gain market share.

Another interesting story is that the largest shareholder of Blackbaud, Clearlake Capital, intends to take the company private with an offer of $71 per share or around a multiple of 13 times EBITDA. The board has rejected the deal and will likely be busy with proxy battles, making it unlikely to change direction at this stage and invest more in the product.

SylogistGov is a 100% SaaS solution for municipal and local governments. It offers three unique cloud-based solutions, that drive efficiency with Microsoft Dynamics 365. Among these offerings are SylogistGov ERP, tailored for local government needs, SAVIN, an advanced victim notification system, and Grants Manager, streamlining award and grant management processes.

From our conversations with the company and several organizations, we’ve learned that many government organisations are using very outdated systems and are in need of significant upgrades. The incentive program of the U.S. government will serve as a significant catalyst in the coming years.

“US government through the American Rescue Plan Act authorized a $350B stimulus for State and Local governments, a majority of which remained undeployed. The deadline for obligating/budgeting funds is December 2024 and the spending deadline is in December 2026. State and Local governments have spent 45% and 38% of the funds allocated, respectively, which implies there could be a strong tailwind from deploying the stimulus over the next several years”

There’s also an additional 15% of the revenue that comes from providing services to various entities in the field of system implementation consulting, payments, payroll, and more.”

Revenue Structure

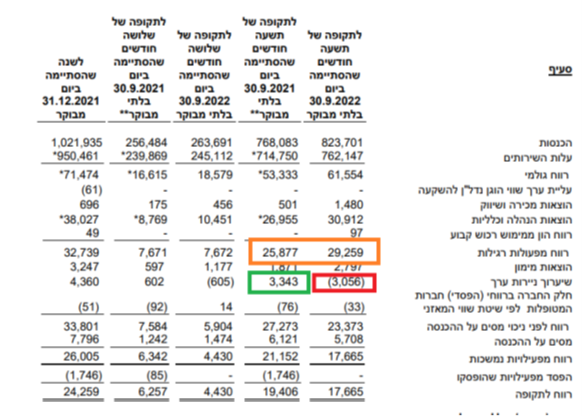

Approximately 60% of the company’s revenue is categorized as recurring revenue, with around 65% of that recurring revenue being true subscription-based revenue (SAAS). The company anticipates increasing its share of recurring revenue in the coming years. The remaining 40% of non-recurring revenue is also relatively sticky, as it involves system upgrades and support based on licensing.

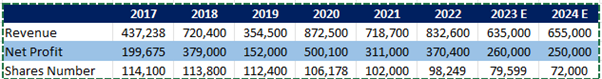

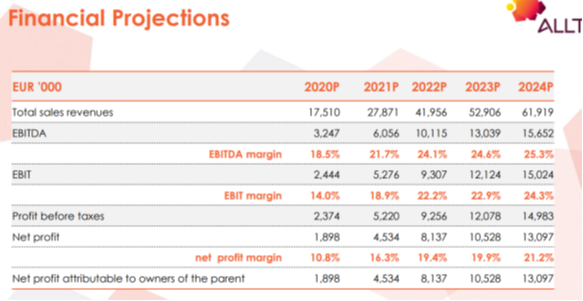

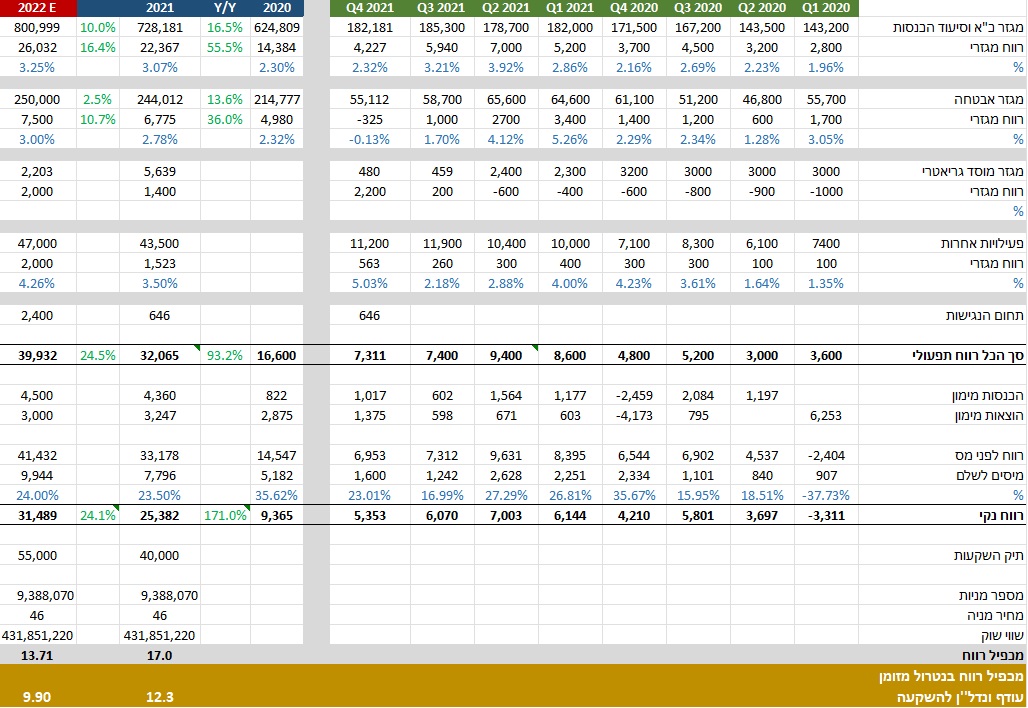

The company operates under the Rule of 40, where the sum of organic growth and EBITDA equals 40. The company’s growth forecast is in the double digits for the near future, with expenditure increases being controlled.

Management

CEO Bill Wood joined the company in late 2020. He was one of the founders of Blackbaud and possesses extensive knowledge in the Non-Profit sector from previous companies. He has been the driving force behind the recent changes within the company over the past year.

In May 2023, the company strengthened its executive team further by appointing Sajeet Kini as CFO. Kini brings significant experience in software companies and SAAS enterprises.

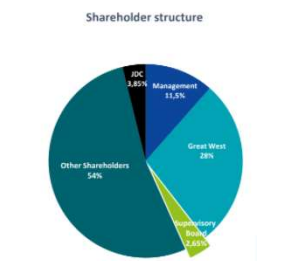

The primary investor in the company is Pender Fund, holding a 14% stake. They have also recently gained representation on the board. It is always good to see board representation with someone aligned with the shareholders.

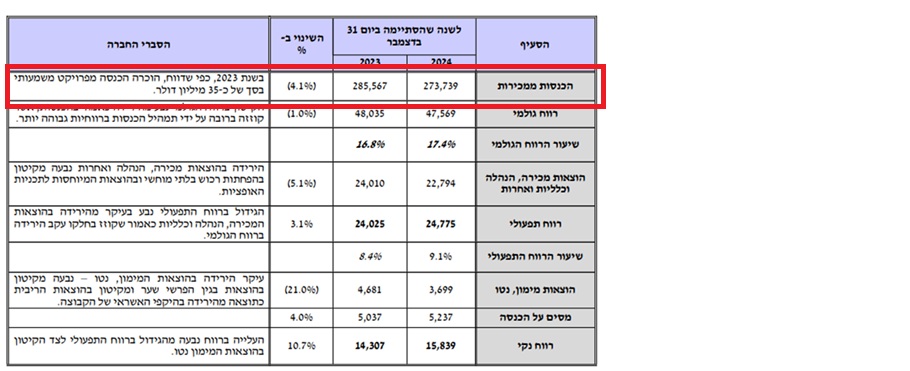

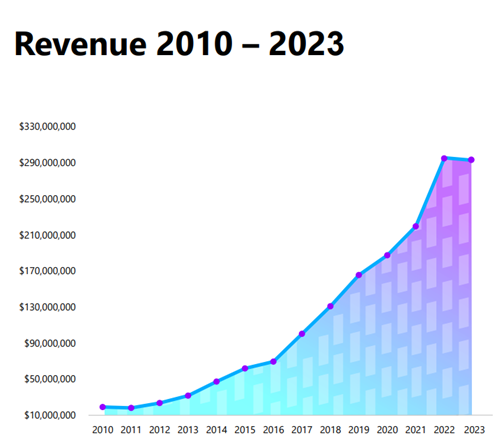

Financial Data

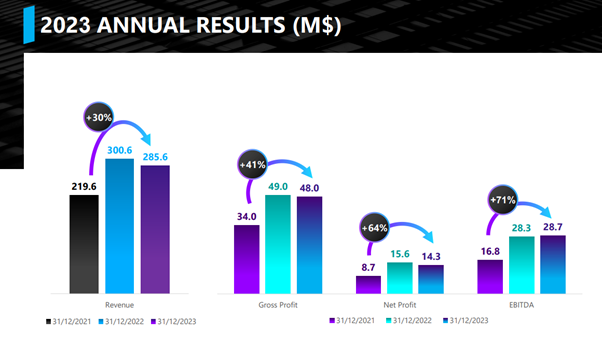

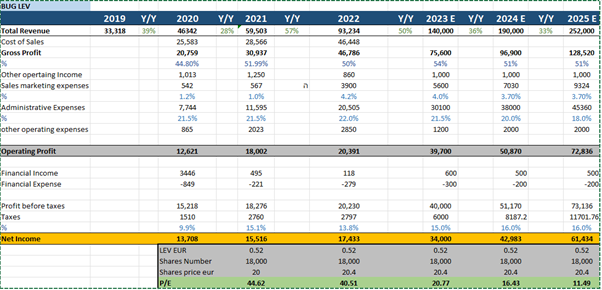

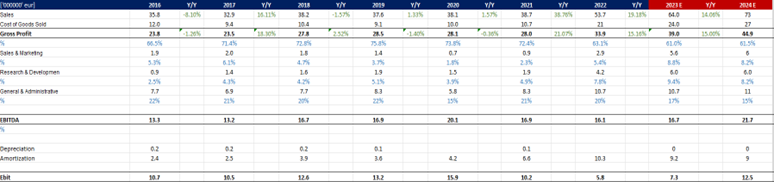

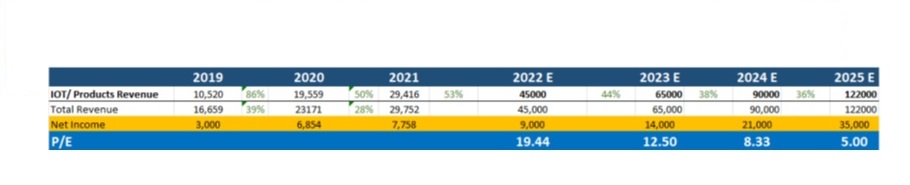

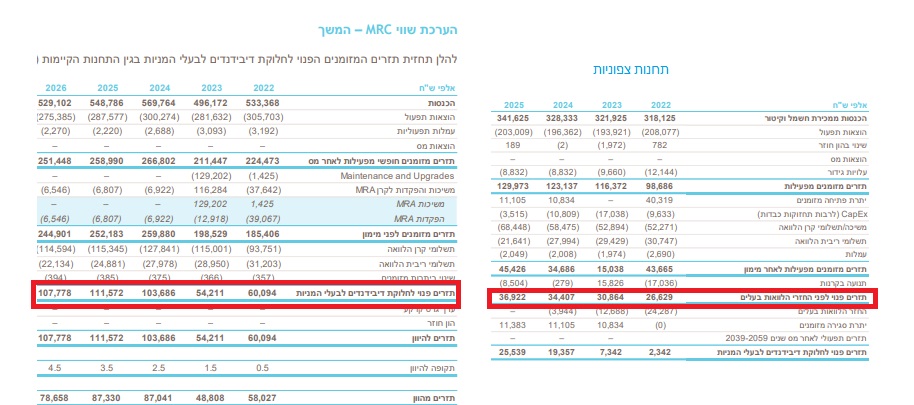

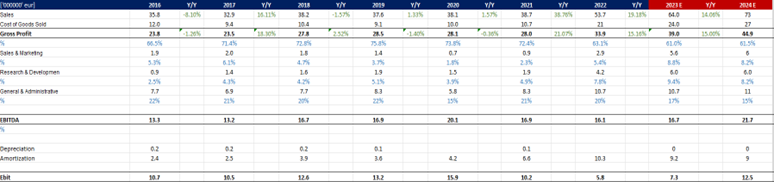

It’s evident from the financial data that the company experienced minimal growth between 2016 and 2021. However, after the change in management, it reverted back to a significant growth trajectory, both organically and through acquisitions. The management forecasts a double-digit organic growth rate and additional growth through acquisitions.

Why do I expect shares to rerate?

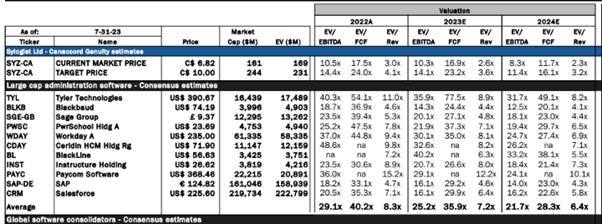

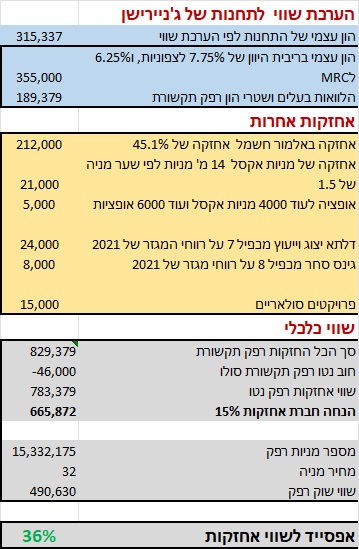

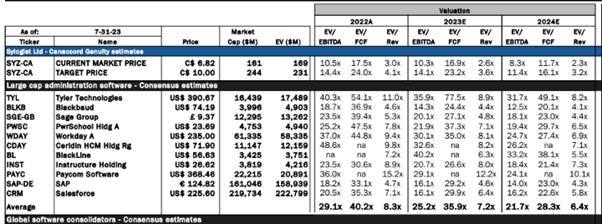

I hope I’ve convinced you that it’s a good business, with stable revenues and growth, both organic and through acquisitions, very capable and ambitious management, and it’s trading at an EV/EBITDA multiple of 10 for 2023, 8.5 for 2024 and around 12 EV/FCF for 2024 , which is roughly half of most competitors despite a much better growth profile.

Source –Canaccord Research

But what’s the story? Why will investors rerate it?

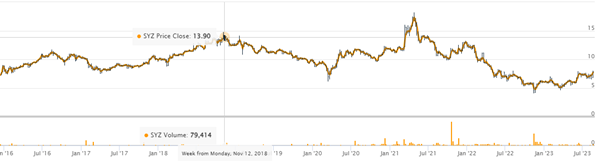

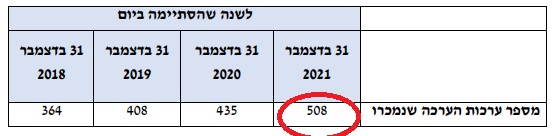

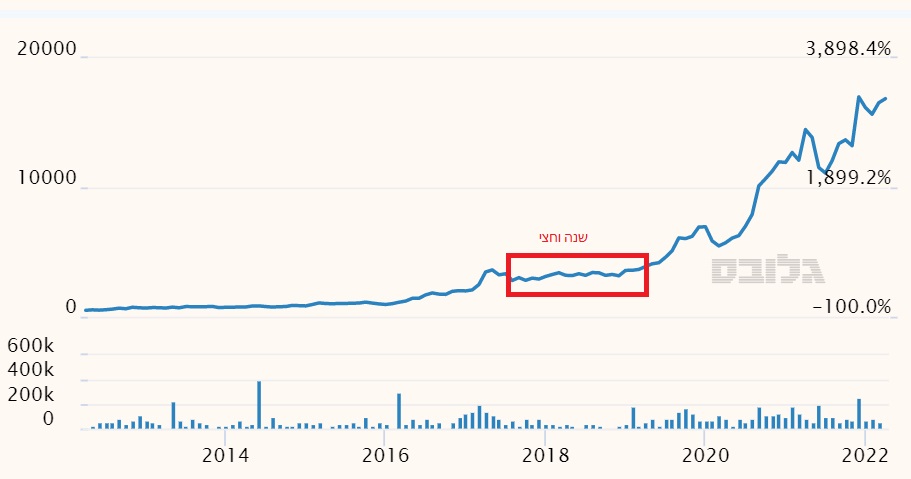

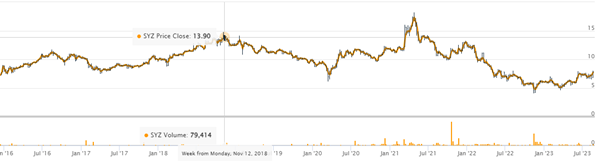

Looking at Sylogist’s financial profile, it seems that the company barely grew between 2016 and 2021, generated around $35 million in revenue, approximately $23 million in gross profit, and about $13-16 million in EBITDA. Yet, how much the market was willing to pay for such a business at those five years?

The business has been traded mostly above $11 (with almost the same share count) and even reached $17 in 2021, which is about 50-60% higher than today’s price, despite the fact that its financial data was much less favorable.

This business generated 40% less in gross profit and still traded at a premium of at least 50% over today’s price—okay, what’s happening here?

The story is simple: Bill, the new CEO, understood that he had a great business on his hands, but he needed to invest in it for the years ahead; otherwise, they wouldn’t capture market share and might even lose customers. Due to the favorable business environment and growth prospects, they decided to cut dividends and invest in growth. This decision makes great sense to a savvy investor who understands how growing SAAS companies are rewarded. However, those who held SYZ stocks consisted of some passive dividend funds. Before the decision, the company had a high dividend yield. In addition, the company is categorized as SAAS and didn’t drop significantly until mid-2022, in contrast to its peers, which created a rebalance within people’s portfolios. All of this contributed to the price spiral, all while the business was improving.

A change in shareholders base can indeed be a very painful experience, and despite all the improvements in the company’s business, the stock remains undervalued compared to its true worth. Why did people pay considerably more for a mediocre business just a few years ago?

Keep in mind that today this is a company generating over $40 million in gross profit and decides how much to invest based on attractiveness. The company could have reverted back to its expenditure levels from 2016-2020 and achieved an EBITDA of $30 million and a free cash flow of $25 million, but is that the right course of action?

It’s essential to evaluate these decisions carefully. Companies often weigh the trade-off between short-term profits and long-term growth. Making aggressive investments might result in slower short-term profits and cash flow but could position the company for stronger, sustainable growth in the future. The market’s reaction might not always immediately reflect the value being created by these investments.

Deciding between maximizing immediate profits and investing for long-term growth is a complex strategic decision that depends on the company’s goals, market conditions, competitive landscape, and investor expectations. It’s a trade-off that many companies grapple with, and there’s no one-size-fits-all answer.

Ultimately, it’s important for the company to communicate its strategy effectively to its investors and stakeholders to help them understand the rationale behind their decisions.

It seems like Sylogist is at a turning point. The company has made significant improvements in its product, support, and cost management. With the new CEO’s efforts to push the product, market it more aggressively, and invest in its development, there’s a strong expectation of growth in the coming years.

The company is gaining traction among investors and has hired new IR services, indicating a growing interest among the investing public. The robust business environment also contributes to this positive outlook. I believe valuation will follow those improvements as well.

In addition to the organic value creation company’s profile might attract potential PE buyers, our discussions with the management indicate that they might not be actively pursuing such an activity right now, given the enormous opportunity to grow the business organically and the current share price that doesn’t even close to approximate fair value.

In summary

Sylogist appears to be an excellent business with a strong management team, trading at a discounted valuation due to suppressed profitability. Even with this suppressed profitability, the company is undervalued by about 40% compared to its cheapest peers despite having a more favorable growth profile and generating much better cash flow. As the company continues to grow its revenue, optimize operations, and adapt to changes, it’s expected to undergo a transformation in the next 12 months, I expect share price will rerate significantly as well.

We hold shares at Sylogist and the research is not a recommendation to act