I promised on Twitter to write about very interesting idea, but due to a shortage of time, it didn’t materialize till now. After a busy earnings season, I do want to write about a new company on my blog. The last three companies I covered in the past two years performed exceptionally: SLYG appreciated about 4 times, QLTU approximately 2.4 times, and SYZ around 40%. I don’t think this track record will continue, but in-depth writing greatly helps me focus my thoughts and review successes and failures (there were some).

I promised on Twitter to write about very interesting idea, but due to a shortage of time, it didn’t materialize till now. After a busy earnings season, I do want to write about a new company on my blog. The last three companies I covered in the past two years performed exceptionally: SLYG appreciated about 4 times, QLTU approximately 2.4 times, and SYZ around 40%. I don’t think this track record will continue, but in-depth writing greatly helps me focus my thoughts and review successes and failures (there were some).

Additionally, due to the unusual performance discrepancy of the Tel Aviv Stock Exchange to world wide indexes, it could be fertile ground for investment ideas traded there, but their activity isn’t closely tied to Israel. Such a company I want to introduce today.

I recommend everyone conducts their own research, and my post is not a recommendation of any kind and i encourage every one to perform their own research

New Investment Idea – Hiper Global Ticker: $HIPR.TA Market Cap: $220M

Not every day can you find a company operating in the most interesting fields globally and riding growing verticals, while it trades at multiple of supermarket chain, but in depressed markets like Israel, you can find very interesting things, especially due to broad sales, even if the company is not directly related to Israel’s operations, and even if it builds AI servers with DELL and NVDA.

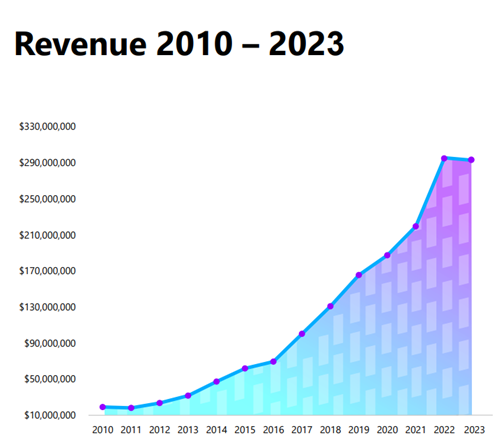

Sometimes timing is everything in investing, so our acquaintance with Hiper didn’t start with good timing. In fact, 2023 was the first year, its revenue decreased after 15 years of consecutive increases, due to a specific problem in a project abroad and slowdown in the semiconductor sector.

It’s important to emphasize that the company operates in sectors that are expected to grow significantly in the coming years, yet it trades at a multiple of 15 on 2023 profits—a challenging year, and I’ll explain why—and around a multiple of 11 on 2024 estimated profits, potentially 6-7 P/E on 2025 numbers with accelerating growth.

Not only that, the company’s true cash earnings are higher than reported profits due to amortization expenses on acquisitions it made, hence it’s trades at a multiple of 13 on 2023 adjusted earnings.

I see several key reasons for the company’s undervaluation: misunderstanding of its competitive positioning, sales pressure of Israeli mutual funds selling things that have risen this year, concern about developments in the war in the north, or simply because today the trend is to buy NVIDIA (a customer of Hiper) and an S&P index fund.

Background on the company

Hiper operates in the OEM computing field, where it customizes, designs, and assembles computer systems integrated into its clients’ end products sold to end customers. The company initially spun off from another computing company and became independent in early 2022, backed by Israel’s leading PE, Fimi.

The company essentially acts as a computing solutions integrator within customers end product. For example, when Hiper client designs a product such as a semiconductor testing machine or a cyber appliance, the client has the know-how to design its product but needs integration with dedicated computing power to process access and store data. Here’s where Hiper comes into the picture and collaborates with the client on the product.

Business Model

The company’s business model is interesting, and here’s the first point of market misunderstanding that thinks the company is project-based when in fact the company benefits years after the project is completed from recurring revenues.

Work stages and revenue recognition:

- Product design – Hiper engineers meet target customers and collect engineering requirements from customers.

- Architectural computing design of the final product – What cloud service the customer needs, what server and what processing power, how to interface correctly with customer systems.

- Preparation of a full product portfolio for the customer – It is at this point that revenue recognition begins, when customer order comes with the Hiper computing solution tailored to it—a critical point, and the global locations of Hiper is very helpful because many times the customer’s product arrives at Hiper’s offices in the U.S. for integration, and many times, Hiper supplies the systems from its offices abroad.

- Revenue keeps coming in as long as the customer provides its products.

Competitive Advantage and Moat

I see several competitive advantages for the company:

- Expertise in executing complex projects and long-term collaboration with customers, mainly from the Israeli high-tech industry that the company can leverage for global operations.

- Global distribution – The company have affiliates and distribution offices across several countries, allowing it to support Israeli customers making global sales and also access global customers.

- Brand – Executing a global project with DELL and NVIDIA (Israel) in building a super AI computer is a gold stamp for company skills.

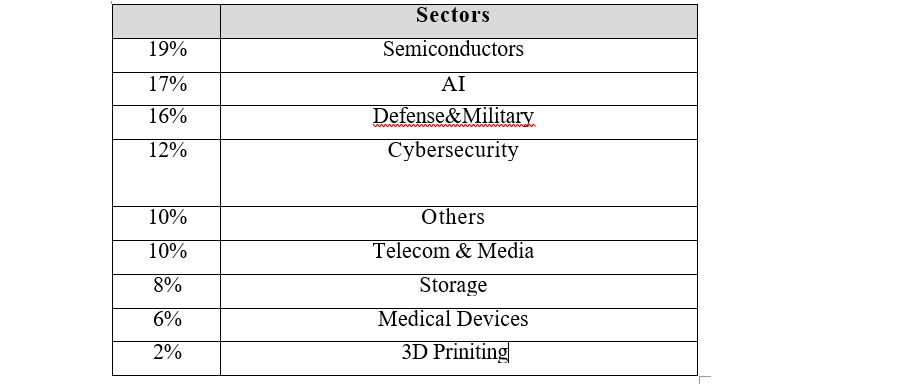

Sectors Exposure

The company’s customers come from the “sexiest” fields in the world today, starting with AI, semconductors, cyber and most are giant companies. At a customer conference I attended last month, I saw tag names of all leading companies, and Dell’s operating manager presented their collaboration with Hiper and said the Israeli operation was very significant in the global company. In addition CEO of Invidia Israel presented and explained about the work company performed on Super Computer and project challenges

Why the opportunity exists?

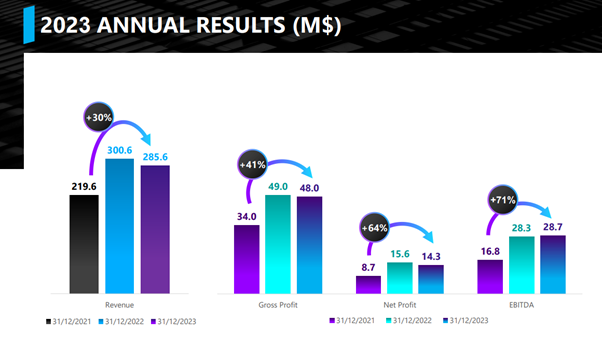

The company’s revenue has grown sixfold in the last 10 years or at an CAGR annual rate of 20% a year when profitability has increased much more. Last year (2023), the company’s revenue fell compared to 2022, and this is the first time the company’s revenue has fallen in the last decade, leading to market perception that the company suffers from inventory problems, but the market completely misses the story in my opinion.

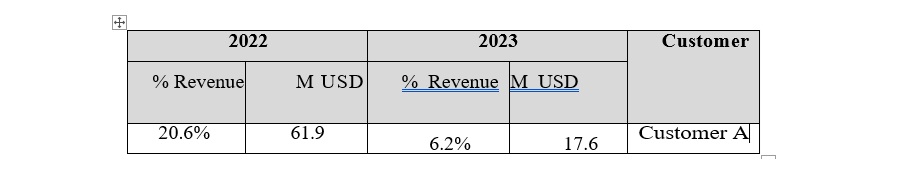

Inventory problems were at one of the company’s largest customers in 2022 leaded to temporarily cease in the supply of systems, but it important to emphasize that project not ceased and it will serve as a tailwind in 2024 when supplies return in addition to other verticals that are improving.

This customer (A) a multi billion private company from USA was responsible for $60 million in sales in 2022 and fell to $17 million in 2023 alone, which led to a decline in sales.

Without a problem with this customer, the company still managed to grow at a double-digit rate even in 2023, while many of the semi companies (very important vertical) reported a decline in sales! !!! For example, NVMI, a leading chip manufacturer, reported a 9% decline YOY, another customer that Hiper provides solutions to and presented at the conference AMAT (APPLIED MATERIALS) showed a stagnation in revenue. Camtek CAMT reported a decline in revenue, Dell reported a double digit decline in revenue.

It seems that many companies in testing equipment and servers showed poor results in 2023 and yet the market is willing to pay multiples of 40 more to those companies mainly because of the foresight ahead.

Project with NVIDIA

In 2023, the company won the NVIDIA and DELL project to build a Super AI computer. The project is based on dedicated servers for the artificial intelligence of Dell Technologies with PowerEdge XE9680 models that combine GPUs of the newest NVIDIA HGX H100 platform. The Hiper share of the project was Integration of NVIDIA BlueField SuperNICs- on the platforms of DELL Technologies Optimization of performance and Benchmark for servers before their implementation.

Integration, assembly, and development verification of server deployment and installation in the data center of NVIDIA, in combination with support services. The choice of Hiper as an integrator for the project shows the company’s value proposition to customers.

It is important to emphasize that the project that Hiper did was with NVIDIA Israel and it is difficult to say whether it will lead to further projects in the future and in additional geographies but the optionality is definitely here in cooperation with DELL.

The project ended already in the third quarter of 2023, but at Q1 2024 company reported work in the field of AI and the CEO stated in a press release that they see a lot of opportunities in the field of AI to carry out projects, that is, the company is becoming a significant integrator in the field of AI especially in the Israeli market. In addition i belive, this project helps a lot in the company’s branding and will help it acquire global customers looking to build AI servers.

Financial numbers

The company has a net debt of $14 million and a market cap of $220 million which means the company trades at an EV/EBITDA multiple of 8 and a net profit multiple of 15 P/E but it is important to note an interesting point!!! The company records amortizon cost above real capex of about $3 million a year which means that the company trades at around a P/E multiple of 13 at pretty weak year due to facts explained above

A forward-looking view and why it’s interesting

The company is in the fastest-growing sectors in the world, and AI revenues have risen from zero in 2022 to 17% in 2023 and Hiper recently upgraded it facility at USA as preparation for growth. If not the temporary problem with the big customer and a very difficult year in semi, the company would have been at other place and remember timing is everything at investments and i think the timing now is on our side.

I think that together with some small acquisitions the company is looking to make, I expect turnover at least a double in 3 years and to surpass $500 million in revenue.

Understanding Hiper’s operational leverage is crucial, so an additional gross profit of $40 million will lead to an operational profit addition of $30 million relative to 2023. The company could reach nearly $40 million in net profit by 2026 (hopefully by 2025, but I don’t want to set expectations too high 😊), which will almost certainly lead to a doubling of the stock price if the current multiple remains depressed and much more if expansion is seen.

Summary:

Okay, I don’t want this to be too long and recommend that anyone interested in the company do their own homework.

We’re looking at a company in business momentum and with growing verticals, with excellent management that has grown the company 30-fold in 12 years, a small company that is a leading partner of many giant companies, with very strong control ownership and experience from Fimi who can help with M&A for further expansion, riding the AI and semiconductor trends, all this beauty at the multiple of a supermarket chain so where is the downside?.

I think it’s likely that Hyper will double itself in the next three years, and even then, it will still have expansion potential. We will encourage the company to publish presentations and reports in English and urge them to consider dual listing in the future.

We may hold shares at companies mentioned and the research is not a recommendation to act

Link To Presentation At English

היי מרק,

תודה על הניתוח (אני לומד הרבה מהאתר ויחסית חדש בתחום)

לפי הדו”ח החצי שנתי יש עליה ביחס ל 2023 אבל לבנתיים זה לא נראה משמעותי

(מחיר המניה ירד עוד יותר מאז פרסום הדו”ח)

האם ציפית שב 2024 תהיה עלייה משמעותית יותר או שאתה מסתכל על טווח ארוך יותר ?

ובנוסף רציתי לשאול מאיפה המידע על לקוח A ? והאם הפעילות עם לקוח A חזרה לגדול שהיה בשנת 2022 ?

תודה

Hi Mark,

Nice idea, I also began researching Hiper Global a few days before you released this idea. Maybe you can help me, because I struggle to find any official filings. Are there any or is the investor presentation the only official document available? i do not really care if it is in english or hebrew.

Thank your

All the best Benjamin

Hello,

Thank you for the presentation. I begun researching HIPER Global a few days before your presenation

I struggle with getting my hands on the official financial statements.

Any idea where I can finde them

Thank you

All the best

Benjamin