It has been nine months since my last post about Hiper (and also last post in general), and I wanted to update readers on the investment and share my expectations for the company in 2025 and beyond.

First of all, nine months isn’t enough time to fully evaluate an investment, but Hiper has continued to disappoint—especially compared to other stocks I’ve written about, like QualiTau (QLTU) Despite this temporary disappointment, I still disagree with the market and based Hiper one of my top positions for 2025 and 2026. In this post, I’ll explain why.

2024 Results

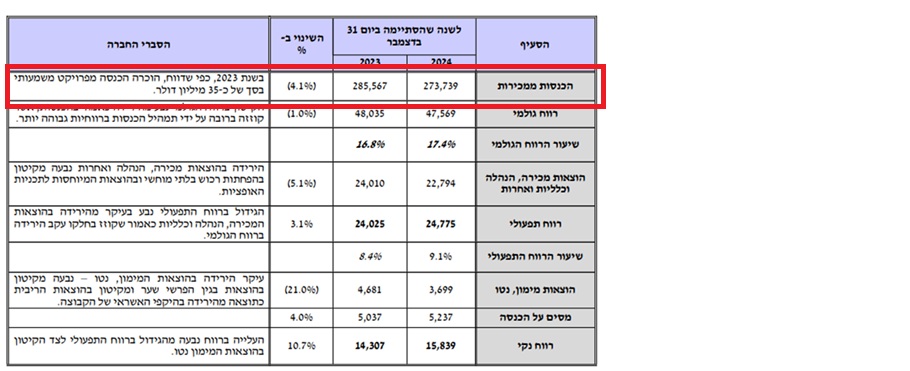

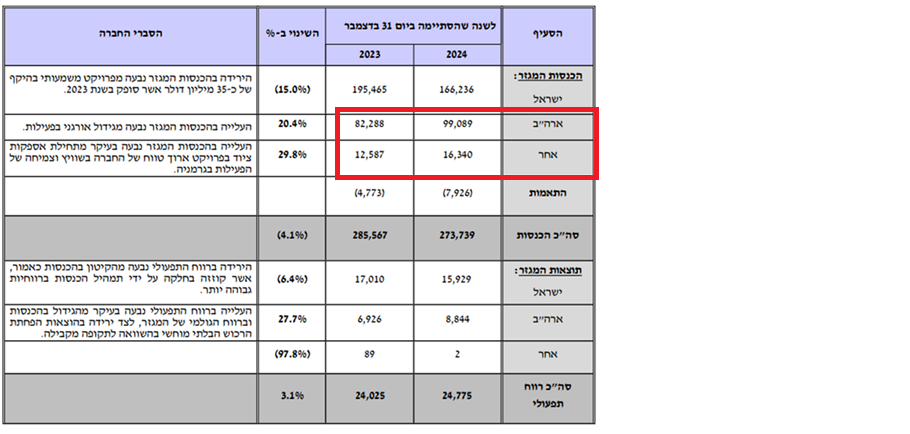

At first glance, it may seem like Hiper’s revenue declined in 2024. However, it’s important to remember that 2023 included a one-time deal with NVIDIA. When adjusting for this, we see that the company actually grew by about 10% in 2024. Moreover, Hiper’s operations in the U.S. and Europe grew by approximately 20%.

The company generated around $16 million in net profit and net income should be adjusted approximately $3 million in acquisition-related amortization. This means Hiper’s actual cash net income was approximately $19 million, against a market cap of $190 million—trading at a P/E ratio of about 10 in what even management considers a disappointing year.

Looking at the EV/EBITDA multiple, a favorite among U.S. analysts, Hyper is trading at a multiple of 7—again, at pretty disappointing year

What the Market Is Missing

I believe the market doesn’t fully understand Hiper and still perceives it as a project-based company. While this is partially true, Hiper typically recognizes revenue throughout the entire duration of a project after winning a contract and completing development. In other words, the company has a relatively stable revenue base, on top of which it layers its growth vectors.

The market has been (rightfully) disappointed by Hiper’s lack of growth over the past two years and remains skeptical about its return to growth. However, I find it highly unlikely that 2025 and 2026 will resemble 2023 and 2024. A major source of disappointment has been weakness in the semiconductor sector. While the industry was strong in certain segments, Hiper depends on a very specific type of machine and certain customers whose installations were delayed due to postponed fab construction in the U.S.

This situation reminds me a lot of Ubiquiti (UI), which a friend introduced me to in early 2024. The company had stopped declining in revenue, and it was clear that profits had bottomed out. Yet, since it was a U.S. company, it bottomed at a P/E of 19, just a hint of returning growth led to a near tripling of its stock price—before actual improvements even materialized.

I’m not saying Hiper will triple in value overnight, but the analogy is clear: we’re at a low-profit point, on the verge of a growth return, trading at a 10–11x multiple, with one of the best management teams in the industry. This setup has explosive potential!

Where Will Growth Come From?

In its annual report, Hiper noted that revenue from its defense sector reached 21% of total revenue. The CEO also emphasized in a press release that the defense business is currently one of the company’s fastest-growing segments. Additionally, I expect this growth to align with a recovery in the semiconductor industry over the coming year.

Because I have a lot of confidence in Hiper’s management, I believe there’s a strategic reason behind their decision to expand manufacturing capacity in both the U.S. and Europe by nearly fourfold. It’s also worth noting that the company has now separated its European segment in its reports—likely signaling imminent accelerated growth.

Here are a few quotes from the CEO’s recent interview with Bizportal:

-

“Our U.S. operations have strengthened, and we’ve also seen significant growth in the defense sector. That segment is skyrocketing. In the U.S., we have a strong presence in Atlanta, we’re working with three major players in Israel, and in Europe, we operate in Switzerland. Deliveries will begin soon. Our defense solutions are more complex than our civilian offerings, which means we also deliver more value in that space.” – I guess they will supply products with much higher gross margins

-

“Global economies delayed the opening of fabs in 2024, which also caused delays for our customers. That’s why we haven’t yet returned to 2022 levels. In the long term, the semiconductor industry is bound to explode, and we’re working with the most relevant companies in the field. The defense sector is already booming and will continue growing.”

There’s a strong chance that this year, demand for semiconductors will converge with Hiper’s momentum in the defense sector.

Additionally, the company has been working hard on an acquisition, which has yet to materialize—causing some frustration. However, I appreciate management’s patience in not rushing into a bad deal just for the sake of making one. When the right acquisition does happen, it will serve as another catalyst for unlocking value.

Conclusion

Hiper is coming off two disappointing years, breaking a 15-year streak of continuous growth. Investor frustration, historically low valuation multiples, and early signs of a growth return could create the perfect storm for a major turnaround—if things start aligning. The company is positioned in all the right verticals, and I expect we’ll hear some exciting developments soon.

We may hold shares at companies mentioned and the research is not a recommendation to act